What is an Opportunity Zone?

By now, most of you have probably heard about opportunity zones. For those that have not, the program was created by the Tax Cuts and Jobs Act on December 22, 2017, to incentivize investment in economically distressed parts of the country through tax benefits. The mechanism provides reductions in capital gains tax liability for investors who make long-term investments into census tracts designated as opportunity zones. Opportunity zones will likely favor shovel-ready development projects, as well as capital intensive renovations of assets under certain conditions.

How it Works

There are several primary considerations for opportunity zone investment regarding timing, product type, and implementation. Below is a summary of what we believe will have the most impact on our clients:

- Capital gains realized after December 22, 2017 must

be invested into one or more Qualified Opportunity Funds (QOF) within 180 days of realizing gain through sale of appreciated assets.

- QOFs are required to have a minimum of 90% of their funds invested into designated opportunity zones. QOFs can invest directly into qualifying real estate and/or make equity investments into qualifying

- A QOF investment may be sold and the tax benefits protected so long as the funds are reinvested into a new QOF investment within 180 This is only for purposes of deferring initial capital gains. The holding period for purposes of deferred tax liability reduction and step-up in basis of opportunity zone investments restarts upon reinvestment.

- Unlike a 1031 Exchange, this program applies to gains from any investment and is not limited to gains from real estate investments. Additionally, this program only requires reinvestment of the gain from the original investment, which leaves the investor free to use the basis as they

- Property investment needs to meet one of two criteria: (1) real estate needs to be put to “original use” with the QOF, or (2) the fund needs to “substantially improve” the “Original use” means that the building was put into service for the first time at commencement of the QOF investment. Certificate of occupancy is assumed to be a reasonable measure for this determination. “Substantially improve” means that the QOF needs to more than double its basis in the property within 30 months of acquisition. These requirements only apply to the improvements and not to the land on which they are sited. Recently proposed regulation indicates that a QOF may be treated as the “original user” of a property that has been unused or vacant for at least five years.

- Land generally qualifies as opportunity zone business property when used in an active trade or business, excluding situations that are viewed as abusive (e.g. land banking strategies). This applies to both improved and unimproved

- Leased property may qualify as business property without substantially improving the property or the tenant being the original The tenant may also be a related party subject to additional restrictions.

- Certain debt-financed distributions to investors may be tax free and working capital held by a QOF may, in some cases, be allowed to extend beyond 30 months when the fund is awaiting approval of

- A partnership or corporation may self-identify as a QOF by filing Form 8996 with their tax

- The gain on the original investment shall be assessed no later than December 31, 2026, regardless of whether or not the QOF investment has been sold.

The Benefits

- If the QOF investment is sold during the first 0 to 5 years - The original gain and any incremental gain on the QOF investment become taxable at that time.

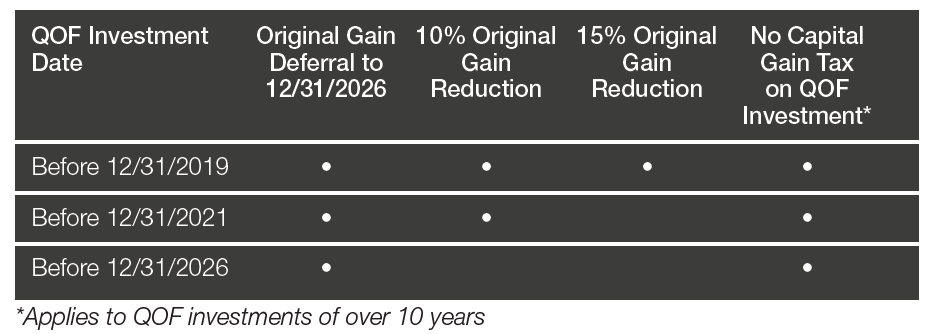

- If the QOF investment is sold during years 5 to 7 - The original gain is reduced by 10%. Not available for first QOF investments made after December 31, 2021.

- If the QOF investment is sold during years 7 to 10 - The original gain is reduced by an additional 5% (15% in total). Not available for first QOF investments made after December 31, 2019.

- If the QOF investment is sold after Year 10 – No gains are incurred on the QOF investment.

Bottom Line

According to David Bitner, Americas Head of Capital Markets Research for Cushman & Wakefield, analysis indicates that this program could add as much as 150-300 basis points to a project’s after- tax Internal Rate of Return.

Opportunity Zones and Agriculture

Many of our clients are interested to learn if this program applies to agricultural land. The most recent IRS guidance seemed to indicate it may be possible, while also providing an example of when an agricultural investment would NOT qualify. The proposed regulation states that, “a QOF’s acquisition of a parcel of land currently utilized entirely by a business for the production of an agricultural crop, whether active or fallow at that time, potentially could be treated as qualified opportunity zone business property without the QOF investing any new capital investment in, or increasing any economic activity or output of, that parcel [emphasis added]. In such instances, the Treasury Department and the IRS have determined that the purposes of section 1400Z-2 would not be realized, and therefore the tax incentives otherwise provided under section 1400Z-2 should not be available.”

We are optimistic that if the property is substantially improved, as described earlier, it may be possible to justify an investment in farmland as a qualified investment. For example, if the land purchased is unimproved, the basis would be zero dollars, and any substantial investment into the property that increases its economic activity or output (such as converting it from row crops to permanent plantings) would seem to qualify. This could have significant impact on regions with farmland suitable for development to permanent crops, such as fruit or tree nut orchards, or vineyards. Given the potential for the tax implications associated with this strategy, it is recommended that you consult with your tax attorney prior to making a QOF investment into farmland.

Finding Value Beyond a Qualified Opportunity Fund

According to data recently released by Zillow, homes sold within an opportunity zone saw an average increase in value of over 20% year over year, while values for homes not within an opportunity zone saw comparably modest increases. It is possible that this trend is a result of those properties selling at a premium to a QOF for redevelopment or renovation. However, it is more likely that buyers believe these economically distressed communities will see outsized capital investment due to this program and, therefore, will see positive change and generate greater value appreciation over time.

So what does this mean? Even if no qualifying projects are realized as part of this program, a community could see a substantial benefit through an increase in investment dollars from non-QOF investors hoping to take advantage of the community benefits the program may generate. This speculation and influx of capital is likely to be somewhat self- fulfilling, creating exactly the kind of investment and benefits the program was designed to foster. In some areas, these benefits aren’t likely to stop at the census tract boundary and it is easy to see how they could spill over into neighboring communities despite them not being within an opportunity zone.

Key Takeaways

- Time is of the essence – The structure of the program is such that the earlier funds are invested and the longer they are held in a QOF, the greater the benefit. The table below summarizes how these benefits are impacted by time.

- Engage professionals early on – Talk to your tax attorney to ensure you don’t inadvertently make a mistake that will disqualify you from taking advantage of these benefits in full.

- Not all opportunity zones are created equal – Like all investments, some will perform better than others. Engage a knowledgeable real estate team to ensure you fully understand the fundamentals of the specific market. Look for markets with strong employment, income, and population growth, as well as those already seeing signs of economi

- No substitute for quality underwriting – The program will likely make a good investment better but is unlikely to salvage a poor

- Time will tell – We won’t know if the program will yield the desired results for many years. If Zillow’s data is an early indicator, the program could be a value driver that generates above average returns for savvy investors and positive externalities for the communities.

- Ongoing questions – The second round of proposed regulations has removed much of the uncertainty from the program and we should start to see increased transaction activity as a result. The most recent round of guidance is generally viewed as being favorable to the taxpayer, which should increase confidence that the ultimate implementation of this program will not be unnecessarily punitive. However, as is the case any regulation of this scale and impact, there are likely to be changes and growing pains as the final details are worked out and ultimately approved.

This article was originally published in the Summer 2019 Terra Firma magazine.

About the author: Matt Davis is a real estate broker with Cushman & Wakefield. He is based in San Diego, CA, and assists clients with the disposition and acquisition of investment grade agricultural and transitional land assets. He is also founding member of the company’s Land Advisory Group and Agribusiness Solutions Team. Matt is a member of RLI and serves the 2019 Future Leaders Committee.