This is part two of a two part series from our partner, AcrePro. You can find the first article here.

While there are no guarantees, farmland investment returns may be influenced by several factors. The type of lease (cash rent or flex-rent), the length of the lease, and appreciation over time of the land itself are a few such factors. While an investor cannot change the market forces that affect appreciation of the land, they can be aware of what property improvements and maintenance measures correlate positively with the value of their farm.

From irrigation to clearing ditches, this article will show you a few ways to add value to your property so you can maximize your ROI and get the best value for your farm.

This article will cover:

Timeline

Budget Considerations

Analysis of the Return on Investment (ROI)

Timeline

Most successful investors consider exit strategies from the beginning. Exit strategies are the way in which you decide to sell the farm to secure the highest possible value.

But what if you don't want to sell your farm in the foreseeable future? Even then, history has shown that well-planned and well-executed improvements can help boost short and long term cash flow, and can set you up for a potentially higher sale price in the end.

While building value through property improvements is better suited for a longer timeline, there are still effective ways that you can add value to your property when working on a shorter timeline.

Longer Timeline

If you are working on a sales timeline that is lengthy or flexible, you may want to consider property improvements that are more long term. Long term property improvements are generally implemented as a way to secure cash flow in the future, meaning the improvement may take time and upfront funding before it actually benefits the property.

Examples of common long term property improvements include:

- Laying drainage tile. Implementing drainage tile based on the soil type on your farm may help reduce soil erosion and increase crop yield. Yield increases may vary upwards of 15% to 25% with properly installed tile systems.

- Land grading or leveling. Land grading or leveling can be used as a way to divert the natural flow of water to fit your crop type, resulting in improved yields by 10.7%-12.9%, less soil erosion, and more manageable water runoff.

- Implementing an irrigation system. Depending on the soil and crop types on your property, an irrigation system may help improve harvest. For example, corn can benefit with up to 170% yield increase with appropriately, well-planned and managed irrigation systems.

These property improvements are expensive, and generally require relatively extensive due diligence to understand your crop rotation, topography, and water rights.

From upgrading an existing irrigation system to clearing ditches, repairs to current farming infrastructure may be less costly, and are still considered a property improvement that may increase the value of your farm.

Shorter Timeline

If you are working on a sales timeline that is limited, you may want to consider property improvements that are more short term. While short term property improvements do not always create cash flow, they may greatly impact the value of your farm.

Examples of short term property improvements may include:

- Cleaning up the property. Having a “storefront” look to your property by maintaining areas that are not farmable is an easy, inexpensive way to add value to your property.

- Updating infrastructure. Internal road systems, equipment, and machinery-accessible driveways are integral parts of a working farm. Updating these may add value to your property.

- Addition of acreage. If there are tillable areas on your property that are not currently in use, allotting a budget to clear these tracts and get them ready to plant will add usable acreage to your property, and is generally indicative of higher rent, and in turn, a higher sale price. Be sure to calculate the cost of registering new tillable acreage with the FSA to determine whether the rent increase and property value increase will outweigh the cost of registering new acreage.

Short term property improvements are less time consuming, and typically more budget friendly, but may make an integral difference in the value of your property.

Budget Considerations

Many property improvements require large amounts of capital upfront but are rewarding in the long term. Before investing in a large improvement, you should complete a thorough analysis of the ROI (Return on Investment) and consider two major factors: The capitalization rate and the long term appreciation (availability of accelerated depreciation should also be considered, but that is a question for your tax professional).

Essentially, is the property improvement worth it?

Capitalization Rate

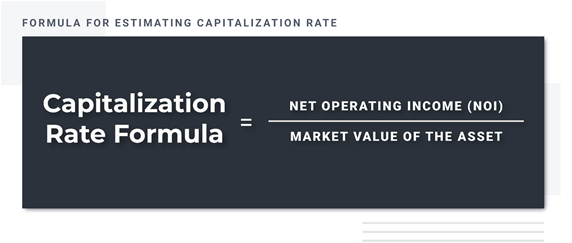

The capitalization rate, otherwise known as the cap rate, indicates the rate of return that an investment property is anticipated to bring. The cap rate is not calculated based on appreciation, but rather on the net income that the property is expected to generate.

When considering property improvements, understanding how that will affect the cap rate, and in turn the cash flow of the farm, will help you decide whether the improvement is financially advantageous.

Long Term Appreciation

Long term appreciation is the appreciation of your land’s value over time and is not calculated based on the net income of the farm. When considering a property improvement, consider the appreciation of your property with and without the improvement to determine if it will impact that value greatly enough to implement.

One approach to determining the added value to your property is reviewing comparative sales (comps) in your area with and without the improvement that you’re considering.

Analysis of the Return on Investment (ROI)

Analyzing the ROI on your property before and after an improvement will help you decide whether a property improvement is worth implementing before listing.

Ask yourself:

- How long do you need to hold the property to realize the gain from the improvement?

- Will the improvement immediately add enough value to the farm to offset the cost of the improvement?

If your property improvement is likely to maximize the ROI via the cash flow created, you might consider holding onto the property so you, as the landowner or farmer, may benefit from short term cash flow via higher rents while simultaneously adding proof of increased yield.

In 2021, irrigated cropland in the corn belt averaged $4,800 per acre, whereas non-irrigated cropland in the corn belt only averaged $3,700 per acre. To fully realize the potential for higher price per acre, this would be an opportunity to hold the property to see the improvement come to fruition before listing.

Final Thoughts

There are so many ways that you can add value to farmland but understanding the impact that each improvement will have on the ROI is the best way to determine what will work for you and your property. An experienced land consultant, like a member of RLI, can help you navigate valuing your farmland.

This article was written by Rachel Bevill-Cottrell and was submitted by our partner AcrePro. Rachel grew up in the rural Arkansas Ozarks on a small ranch in the bend of Piney Creek. She competes in barrel racing, raises and sells horses, and owns a small hobby farm and ranch business. She enjoys writing about farming, agriculture, and all things land related.

This article was written by Rachel Bevill-Cottrell and was submitted by our partner AcrePro. Rachel grew up in the rural Arkansas Ozarks on a small ranch in the bend of Piney Creek. She competes in barrel racing, raises and sells horses, and owns a small hobby farm and ranch business. She enjoys writing about farming, agriculture, and all things land related.