Editor's Note: This is a guest article from our partner, Land Line Lending.

Many first-time buyers are surprised to learn that land lenders do not use the same formula when determining buying power as residential lenders. Residential lenders commonly use Debt to Income ratios while land lenders use a consumers’ Debt to Asset ratio to determine if a buyer can be pre-approved. This means that you could easily be approved for a home; however, a land lender might turn you down for a vacant land loan because it is considered a risker loan. We’ll take a look at how to calculate your buying power and why land is considered risky to some lenders.

A land lender can make the process smoother

Many traditional lenders consider land to be a risker loan because they do not understand the resale value. With a smaller market for vacant land, and no home to see or touch, traditional banks think they won’t be able to sell land quickly if a buyer defaults. In times of financial hardships, lenders feel that vacant land buyers are much more likely to default on a piece of land than they are on their home. Therefore, many traditional banks and residential lenders do not have raw land lending products.

Higher interest rates are standard on land tracts. You will often find that loans for land are 1%-3% higher than current home mortgage rates, across all available lenders. In addition to higher interest rates, you may also discover that land loans require higher down payments as well. While all of this might seem overwhelming, land lenders do have specialized experience in land that will often make the closing go more smoothly, while allowing for less delays and, most importantly, surprises!

Know your debt to asset ratio to understand borrowing power

Debt to Asset ratio is a leverage ratio that allows lenders to calculate the percentage of your assets that are financed by your debts; essentially this tells the lender about your ability to repay your debts and the risk associated with lending money to you. Higher ratios indicate more financial risk to the lender.

In order to calculate your ratio you will want to prepare a list of all your debts and assets. Items to list as assets will be all real estate owned, possessions, bank account totals, businesses, automobiles, equipment, investments, and other items that have an associated cash value. Debts will include short-term and long-term payments that you are making, such as home loans, student loans, automobile payments, medical bills, credit card totals, and personal loan. Some items can be listed as assets and debts, such as real estate. For instance, if you have a home worth $350,000 with only $150,000 left on your loan, you can list it as both an asset and a liability.

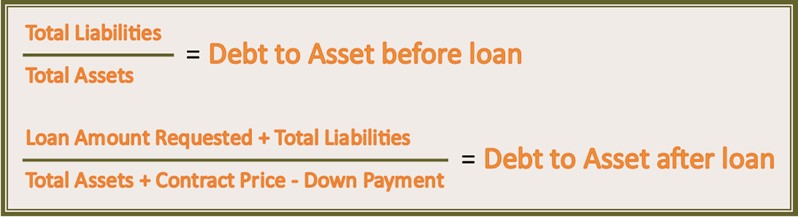

Your debt to asset ratio will be calculated as your total liabilities divided by your total assets. You will want to determine your debt to asset ratio before, and after, adding in the debt from a new property. A high ratio is considered to be .55 or higher, which makes it much more difficult to borrow money. A pre-approval is granted for those with a Debt to Asset ratio, after loan, of 50% or less. Try this formula to determine your debt to asset ratio before a loan.

For example, if you have assets of $250,000 and liabilities of $100,000, your before-loan debt to asset ratio would be .40. To calculate your after-loan ratio let’s assume you want to borrow $120,000 on a property with a contract price of $160,000 and $40,000 in down payment. Using the above formula your after-loan debt to asset ratio would be .59.

Move forward with your land loan

When you are ready to move forward with a loan pre-approval, Land Line Lending is available. Land makes a great investment, and we are available to answer all of your land financing questions. Find out more about your lending options; get in touch with Land Line Lending to get started.